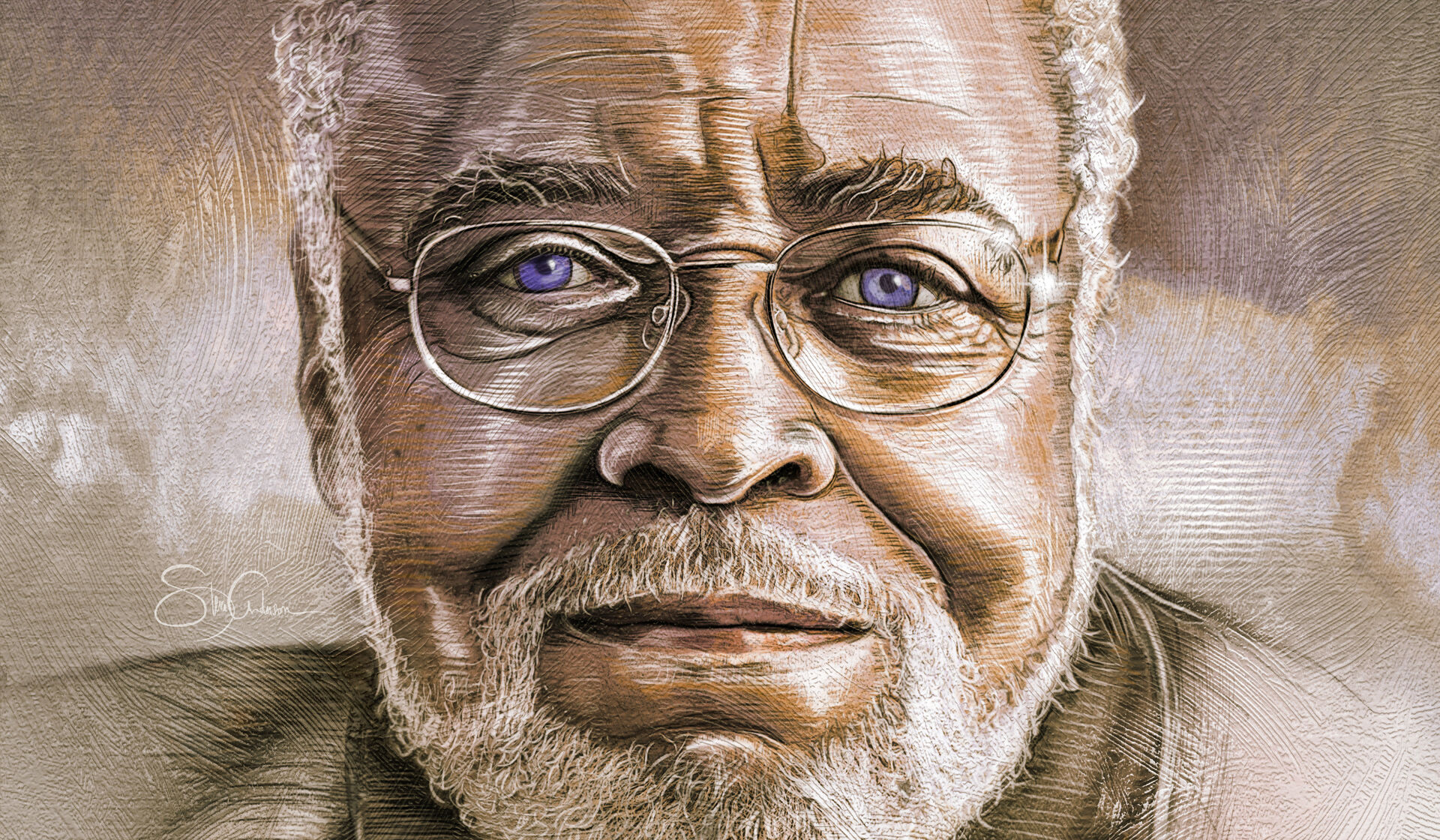

Sam Zell, ’63, JD’66, HLLD’05, never intended to write a book. Yet a hardcover sitting on the edge of his desk bears his name anyway—the project largely fueled by a sense of responsibility to his nine grandchildren.

“Am I Being Too Subtle?” charts the unorthodox course of Zell’s life and his rise as one of the nation’s most successful, iconoclastic business moguls. Like the motorcycle-riding, mystery-reading, self-made billionaire himself, the autobiography embraces simplicity and candor—simultaneously a celebration of successes, an acknowledgment of shortcomings, and an admission that his contrarian approach has spurred both loyalty and loneliness.

Michigan Alumnus gleaned the following in a recent conversation with Zell, namesake of U-M’s Zell Lurie Institute. We met at his downtown Chicago office, where every day is casual Friday and two ducks—mascots of Zell’s Equity Group Investments—meander on an outdoor terrace with a heated pool.

Zell calls writing his autobiography the “hardest thing” he’s ever done. “The idea of expressing myself and telling anecdotes and experiences that I lived and decisions I made without being able to later address them … was very threatening and challenging.”

His parents fled Poland to escape the Holocaust. Zell says he inherited their drive, resilience, self-determination, and willingness to challenge convention. “They gave me a hell of a template to follow.”

As a political science undergrad, he managed a 15-unit student apartment building at 915 S. Division St. His management contract included collecting rent, fixing toilets, vacuuming common areas, cutting the grass, and renting apartments. It was the grassroots, unglamorous genesis of a real estate career that has taken him around the world.

Though many avoid risk, Zell embraces it. “Taking risks is really the only way to consistently achieve above-average returns—in life as well as in investments.”

Many know him by his “Grave Dancer” nickname, a nod to his penchant for investing in devalued or neglected assets. He purchased railcars when the industry was crumbling and invested in manufactured home communities when others shunned such deals. “ what makes sense to me.”

When a fellow investor told Barron’s he’d “take a pass” on following Zell into the less-than-desirable mobile home market, Zell took note. After a robust IPO, Zell sent the reluctant investor a football with a note: “If you’re going to pass, maybe this will help.”

Zell recalls standing in the lobby of a New York City bank in the early 1990s after negotiating the purchase of a North Carolina office building. Awaiting a car ride, he wondered why others didn’t share his embedded sense of urgency and opportunistic nature. “That’s when I realized that success and loneliness are together.” Today, he accepts his outlier status—unsettling as it has sometimes been. “When you go left and it turns out to be the right choice, it’s a lot easier to do it a second time, then a third time. You realize conventional wisdom is not a winning formula.”

From his struggles to balance work and family responsibilities to an indictment (Zell was cleared), Zell’s autobiography acknowledges faults and failures. “The idea of writing a book and cherry picking successes has no reality for me. I’m the first person to criticize myself, to laugh at myself, because if you can do that, then you can accomplish an enormous amount.”

From his struggles to balance work and family responsibilities to an indictment (Zell was cleared), Zell’s autobiography acknowledges faults and failures. “The idea of writing a book and cherry picking successes has no reality for me. I’m the first person to criticize myself, to laugh at myself, because if you can do that, then you can accomplish an enormous amount.”

Zell’s 2007 purchase of the Tribune Co. in Chicago and his subsequent attempts to transform what he considered an outdated operating model in a meaningful industry—albeit with some admittedly harsh language and daring moves—sparked its share of intense public criticism. Even so, Zell charged ahead. “I had never shied away from the heat of taking a company or industry in a new direction.”

Less than one year after Zell assumed ownership of the Tribune Co., the company filed for Chapter 11 bankruptcy protection. “I never lost as much money as I did in the Tribune, but I’d do it again. The risk-reward motivates me.”

Zell views his investments like his children, nurturing them with commitment and effort before sending them off into the world. Though he’ll monitor a former investment’s post-transaction progress, he never regrets turning an investment loose when it’s time.

Zell acknowledges he can be blunt, direct, even crass. “Frankly, this keeps a lot of people away from me because if you’re offended by reality, then you’re not likely to be my best friend.”

Though a restless student at U-M, Zell savors his education today, particularly law school. “I’ve spent my whole career challenging conventional wisdom and creating my own playbook. You can’t do that unless you understand the rules of the game and play well within the lines.”

Zell calls his enterprise “a meritocracy with a moral compass” and rejects the notion that conspiratorial activity and business success go hand-in-hand. “There’s a big difference between climbing over people and passing them.”

At 76, Zell rejects any retirement talk. “Retire from what?”

Daniel P. Smith is a Chicago-based journalist. In previous issues of Michigan Alumnus magazine, he has covered U-M alumni entrepreneurs, including Five Guys Burgers and Fries founder Jerry Murrell and SkinnyPop founder Andy Friedman.